Selling a house with foundation issues can be stressful. Many homeowners worry about legal risks and losing money. There are strict rules about disclosures and documentation.

If you do not follow the laws, you may face lawsuits or big financial losses. Buyers have strong rights, and mistakes can be costly. Missing important steps can create long-term problems.

You must understand and follow all legal requirements when selling a house with foundation problems. Work with experts and be honest in disclosures.

This approach protects you and helps you avoid trouble. This blog will guide you through the legal process and help you sell your house safely and legally.

Key Takeaways

- Sellers are legally required to disclose all known foundation issues and past repairs to avoid lawsuits and penalties.

- Detailed documentation, including inspection reports, repair estimates, and engineering assessments, is essential for transparency and legal compliance.

- “As-is” clauses limit repair obligations but do not remove the duty to disclose known defects to buyers.

- Consulting local real estate professionals and attorneys ensures all disclosure forms and contracts meet regional legal requirements.

- Failing to disclose foundation problems can result in canceled sales, financial penalties, or legal action from buyers.

Understanding Foundation Problems and Their Impact

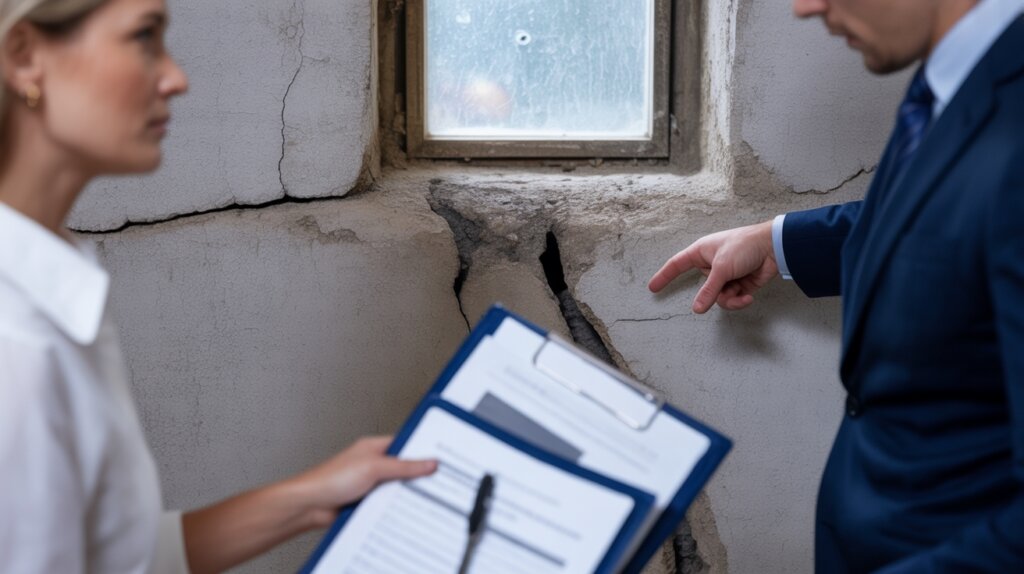

Foundation problems can lower a home’s value and threaten its structure. If you plan to sell a house with these issues, get a professional inspection first. An expert can tell you what caused the problem and how serious it is.

A licensed engineer should then do a full structural check. This report will say how the damage affects the house’s safety and strength. If you have this report, buyers and lenders may trust your property more.

Buyers often offer less for homes with foundation issues. Some may ask for repairs before closing the deal. If you know the risks and have clear reports, you can answer buyer questions and share all needed documents. Additionally, understanding the types of foundation issues can help you better explain your property’s condition to potential buyers.

Being aware of liens and their resolution processes can also prepare you for any financial or legal challenges related to the property, ensuring a smoother sale.

State and Local Disclosure Requirements

You must comply with mandatory disclosure laws that govern the sale of homes with foundation issues, but the specific requirements vary significantly by state and locality. It’s essential to understand how regional regulations impact what you need to disclose and the documentation required.

Failing to meet these obligations can expose you to legal and financial liabilities in your transaction. Additionally, understanding local laws and regulations related to property disclosures ensures compliance and helps prevent potential legal disputes. Recognizing the impact of hoarding on property value can also influence disclosure obligations and the extent of information you need to provide to buyers.

Mandatory Disclosure Laws

Mandatory disclosure laws require home sellers to share known property defects. These laws help buyers make informed decisions and protect sellers from future claims. If you do not disclose issues, you could face legal trouble.

Sellers must list any known foundation problems in writing. Any past foundation repairs should be documented with invoices if possible. Inspection reports should be provided if the law or buyer requests them.

If the home still has structural risks, this must be stated clearly. These rules ensure buyers know the home’s real condition. Following them is necessary for a legal and smooth sale.

Regional Variation in Regulations

Regional regulations for real estate disclosures can differ widely. States and cities often have their own rules for reporting foundation problems. Sellers must follow these local rules to avoid issues.

Some areas need engineering reports or inspections for foundation defects. Others require sellers to sign legal statements about past repairs. Zoning laws may also affect what repairs a buyer can make after purchase.

If you do not meet these rules, you may face delays or legal trouble. Always check with a local real estate expert before listing your property. This ensures you follow every local requirement.

The Importance of Full Transparency

Full transparency in real estate protects you from legal problems and penalties. It means sharing all known foundation issues with buyers. This honesty helps everyone avoid misunderstandings. Additionally, providing a thorough title search review can reveal existing claims or liens that need to be addressed before sale.

Buyers want to know about soil stability and past repairs before buying. Providing reports and repair records lets buyers make informed choices. If you disclose everything early, you speed up the process and lower the risk of the deal falling through. Non-disclosure can bring fines from regulators.

Clear communication about any foundation problems builds trust with buyers. Being aware of structural damage and addressing it proactively demonstrates good faith and can prevent future disputes. If you want to protect yourself and your reputation, always be open about these issues.

Legal Ramifications of Failing to Disclose

If you do not disclose known foundation issues, you could face legal trouble. Laws require sellers to tell buyers about major defects. Buyers can sue you if you hide these problems.

Courts may rule against sellers who conceal foundation defects. This can lead to canceled sales, repair costs, or other penalties. Some states also impose fines for failing to disclose material issues. Proper disclosure procedures are critical in minimizing legal risks.

Real estate laws often require you to fill out disclosure forms. Not following these rules can bring more legal and financial problems. If you have foundation concerns, you should report them to avoid risk. Disclosure requirements are essential to protect yourself legally when selling.

How to Document Foundation Issues

Documenting foundation issues protects you from future problems and meets legal requirements. You must collect clear evidence to support your position. This helps you explain the home’s condition to buyers.

Take date-stamped photos of every crack or uneven area. Include wide and close-up shots to show the damage. If you use clear photos, buyers can see the issues for themselves.

Get written reports from a licensed engineer or foundation expert. Attach repair estimates and insurance papers to your records. These documents provide proof if someone questions your disclosure.

Save all invoices, warranties, and permits from repairs. These papers show you handled problems responsibly. If buyers ask for proof, you will have it ready.

Good documentation builds trust with buyers. It also makes the selling process smoother if questions come up later.

Additionally, understanding the local real estate market insights can help you better position your property and address potential concerns about repairs or issues upfront. Properly disclosing property defects according to Kentucky’s legal standards is crucial to avoid future liability.

Working With a Real Estate Agent

A real estate agent helps you sell a house with foundation issues. The agent guides you through legal disclosures and pricing. You get expert support to avoid mistakes.

The agent explains what you must tell buyers about foundation repairs. They help you collect documents like repair bills and engineering reports. This builds trust with buyers.

If you need to price the house, the agent uses local sales data. They consider the foundation problem and repair costs. You can get advice on when and how to list your home.

If you want to avoid legal trouble, use a licensed agent. They help keep your sale on track and reduce your stress. Working with an expert can make the process much smoother.

Understanding legal disclosures and documentation is crucial to ensure a smooth sale and avoid future disputes. Ensuring that all clear title requirements are met can help prevent legal conflicts after the sale.

The Role of Property Inspections

You should prioritize early detection of foundation issues through a comprehensive property inspection, as this can mitigate liability and strengthen your disclosure position. Engage a licensed inspector with specific experience in structural assessments to ensure regulatory compliance and credibility in the transaction.

Proactive inspections not only inform pricing strategy but also support transparent negotiations with buyers. Addressing structural problems promptly can prevent costly repairs and improve the home’s marketability. Additionally, understanding title issues and potential legal complications related to foundation damage can help facilitate a smoother transfer of ownership.

Importance of Early Detection

Early detection of foundation problems helps avoid bigger issues later. It ensures you follow legal rules and reduce risks. Quick inspections can save money and keep your property safe.

Cracks in the basement walls, if found early, stop water from getting in. Inspections can document these issues for repair records. Early action also gives proof for any future claims.

Uneven floors found during inspection help you meet disclosure rules. Buyers know what to expect before making decisions. This can make selling smoother and more transparent.

If inspectors spot shifting door frames before selling, you can fix problems in advance. This strengthens your position in negotiations. Timely repairs protect your property’s value and legal standing.

Inspector Qualifications Matter

Inspector qualifications are important for accurate foundation assessments. An inspection only helps if it meets industry and legal standards. Always check that your inspector has the right license, certification, and experience.

Some inspectors lack the skills to spot structural problems or suggest repairs. Choosing an unqualified inspector can cause legal issues and missed details. If the market requires it, buyers and lenders will carefully review inspection reports.

Every inspector should use approved methods and follow local rules. If you hire a qualified inspector, you lower your legal risks. Reliable inspection reports help you provide proof to buyers and make negotiations smoother.

Negotiating Repairs or Price Adjustments

Negotiating repairs or price adjustments is common when foundation problems are found. Buyers and sellers often agree on repairs or a lower price. This helps both sides reach a fair deal.

You should check the property’s structure and estimate repair costs before talks begin. If you know the likely expense, you can negotiate with clear facts. Most places require legal disclosure of any foundation problems.

Sellers may get several repair estimates to show real costs. Price reductions can match the expected repair bill and give buyers flexibility. Some buyers prefer a repair credit at closing so they can handle the work themselves.

Good negotiation protects everyone’s interests and follows the law. Being aware of building code compliance requirements and potential violations can help you make informed decisions during negotiations. If you are open and prepared, you can find a solution that works for all.

Using “As-Is” Clauses in Sales Contracts

An “as-is” clause tells buyers they are purchasing the property in its current condition, including all existing problems. This means you are not promising to fix anything before selling. The clause can reduce your repair obligations but does not remove your legal responsibilities. An as-is clause means buyers accept the property with its current issues, and sellers aren’t required to make repairs before closing.

Sellers must still follow state disclosure laws about known issues. If you hide important facts, you may face lawsuits for fraud. An “as-is” clause does not protect you if you break disclosure rules.

Many investors look for “as-is” properties because they expect a lower price. Risk-averse buyers may avoid these types of sales. You should expect fewer offers from typical homebuyers.

A real estate attorney can help you write proper contract language. Local laws on “as-is” sales differ by location. Legal advice ensures your contract is both fair and enforceable.

Obtaining Professional Assessments and Estimates

Before selling a home with foundation issues, get a licensed expert to inspect the property. A professional assessment explains the exact condition of your foundation. This helps you understand the problems and gives buyers clear information.

An engineer or foundation specialist will detail any damage found. Their report strengthens your legal disclosures and supports honest negotiations. If you have reliable documentation, buyers may trust your listing more.

You should also get itemized repair estimates from qualified contractors. These estimates show buyers the expected costs and repair timelines. Clear estimates can make your home more attractive to serious buyers.

Essential documents include the structural assessment report, photos of foundation damage, and written repair estimates. If you present these documents, you show transparency and meet legal requirements. This approach can help your home stand out in the market.

Buyer’s Rights and Legal Protections

Buyers have legal rights that protect them during real estate transactions. Sellers must tell buyers if they know about foundation problems. If sellers hide issues, buyers can take legal action.

Most places require sellers to fill out written disclosure forms. These forms help buyers learn about property problems before buying. Title insurance protects against hidden legal issues but not always against old structural problems.

Buyers may ask for more warranties or a lower price if they find issues. All documents should be clear and truthful to avoid legal trouble. Accurate paperwork helps make the sale fair and smooth for everyone.

Handling Lender and Appraisal Challenges

Lenders and appraisers are cautious when a house has foundation problems. Lenders want to know the home is safe and can be sold later. Appraisers often lower the home’s value because repairs are needed.

Lenders may ask for a detailed inspection from a structural engineer. If the report shows problems, lenders might only approve a loan if repairs are made first. Some loans, like renovation loans, may be allowed if the buyer agrees to fix the issues.

Appraisers will consider the repair costs and the effect on the home’s value. If similar homes in the area have sold for less due to foundation problems, the appraiser may lower your home’s value too. If the value drops too much, the lender could deny the loan.

Considering Cash Buyers and Investors

You’ll find that cash buyers and investors are often more receptive to properties with foundation issues, as they assess risk differently than traditional buyers. To attract serious investor interest, you should price the property to reflect repair costs and market uncertainty. Expect investors to negotiate aggressively for price reductions, leveraging their experience with distressed assets and quick-close transactions.

Attracting Investor Interest

Sellers can attract investors by focusing on the property’s value and future potential. Investors are more comfortable with foundation issues than typical buyers. Highlight profit opportunities and provide clear legal information.

Detailed inspection reports help investors understand repair needs and costs. Sellers should share these documents to build trust. Transparency makes investors more likely to consider the property.

If property taxes might change after repairs, sellers should explain this clearly. Investors can then estimate future costs. If the tax impact is high, they may adjust their offer.

Zoning rules can affect how the property is used or developed. Sellers should explain any restrictions or new opportunities. If zoning allows redevelopment, investors may see more value.

Negotiating Price Reductions

Investors and cash buyers want lower prices if a home has foundation problems. They base offers on repair costs and possible resale value. If you want a price cut, you must show repair estimates and engineer reports.

Proper documents help prove why the home is worth less. Buyers expect a discount for both repairs and extra risks. If you cannot provide proof, buyers may walk away or offer less.

Foundation issues can affect title transfer and closing. You must follow state rules and disclose all defects clearly. If you do not, you could face legal trouble after the sale.

Cash buyers prefer quick closings and do not need loans. If you meet their needs, you can close the deal faster. Knowing what investors want helps you negotiate a better sale with less risk.

Protecting Yourself With Proper Legal Advice

Proper legal advice helps you avoid problems when selling a house with foundation issues. An attorney can guide you through the disclosure and repair process. This protects you from legal trouble after the sale.

You should gather all documents about foundation repairs. These include engineering reports, invoices, and any warranties you received. Full records show buyers you are being honest.

Your attorney should check that all disclosures follow local laws. Sales contracts must also meet state requirements. If you skip this step, you could face future legal issues.

Consider asking your lawyer to add special contract terms. “As-is” language or indemnification clauses can limit your responsibility later. These protections help keep you safe if problems appear after the sale.

Conclusion

If you plan to sell a house with foundation issues, you must follow all disclosure laws and provide honest documentation. If you choose to be transparent, you can build trust with buyers and avoid legal problems. If you consult legal and real estate experts, you can complete the sale with confidence.

If you want a simpler option, we buy houses for cash, even if they have foundation problems. If you contact us, OC Real Estate can make the process fast and stress-free. We offer a fair price and take care of the paperwork.

If you are ready to sell or have questions, reach out to us today. We at OC Real Estate are here to help you every step of the way. Let us make selling your house easy and secure.